| For Internet filing, applicable sections in the Appendix will be automatically completed by the system. No input is required.

|

| |

| Section

2 |

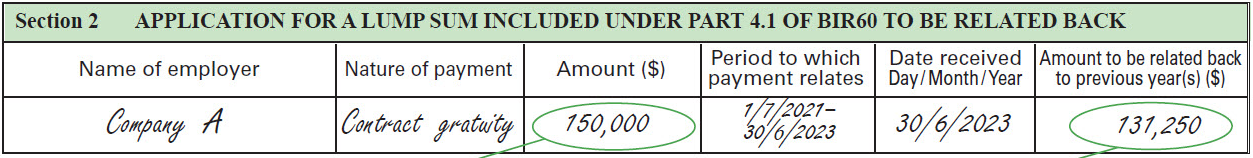

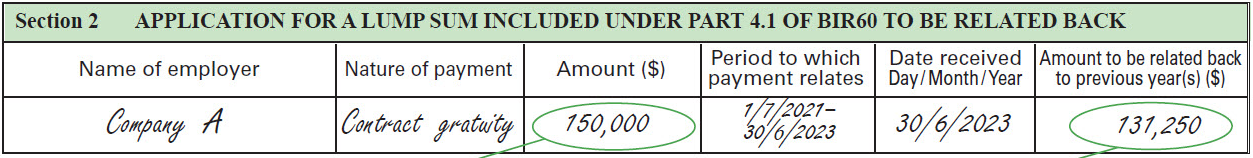

Application for a Lump

Sum Included under Part 4.1 of paper

return BIR60 to be Related Back |

| Please refer to the example

in Part 4.1 of this Guide. |

|

| |

This amount should have been included in Box  and

and |

This amount should be stated in |

| |

should be stated in Box  in Part 4.1 of BIR60.

in Part 4.1 of BIR60. |

Box  in Part 4.1 of BIR60. in Part 4.1 of BIR60. |

|

| |

| Section

3 |

Relief claimed under Double Taxation Arrangement(s) |

|

Tax credit relief is only applicable if you are a person who is resident for tax purposes in |

|

Hong Kong (Hong Kong resident person). |

|

For the meaning of ‘resident for tax purposes’ in relation to any double taxation |

|

arrangements, please refer to the provisions of the arrangements relating to the |

|

determination of resident status. |

|

If you were a Hong Kong resident person during the year and had to pay tax on any |

|

income derived from a territory outside Hong Kong with which double taxation |

|

arrangements have been made, you are entitled to claim a relief under section 50 of |

|

the Inland Revenue Ordinance by way of credit against tax payable in respect of that |

|

income in Hong Kong. |

|

List of the countries / territories is available at www.ird.gov.hk/eng/tax/dta_inc.htm. |

| |

| Section

4 |

Application for Full / Partial Exemption of Income Included under Part 4.1 of paper

return BIR60 |

|

You may apply for full or partial exemption from salaries tax in any of the following situations: |

| |

(a) If you hold a non-Hong Kong employment, you will only be chargeable in respect of |

| |

income derived from services rendered in Hong Kong per section 8(1A)(a). |

| |

(b) If you rendered all services outside Hong Kong during the year, your income |

| |

is excluded from charge per section 8(1A)(b)(ii). |

| |

(c) If you have paid tax of substantially the same nature as Hong Kong salaries tax to |

| |

a territory outside Hong Kong in respect of income derived from services rendered in |

| |

that territory, the relevant income is excluded from charge per section 8(1A)(c). |

| |

(For a year of assessment beginning on or after 1/4/2018, section 8(1A)(c) does |

| |

not apply to income derived by a person from services rendered in a territory |

| |

which has made a double taxation arrangement with Hong Kong. |

| |

If you were a Hong Kong resident person during the year and derived |

| |

income from services rendered in such a territory, you may claim |

| |

relief by way of tax credit in Section 3.) |

| |

(d) If your income is derived from being a member of the crew of a ship or an aircraft and |

| |

your presence in Hong Kong is not more than 60 days in the year and 120 days in two |

| |

consecutive years, one of which being the current year, your income will be exempted |

| |

from tax per section 8(2)(j). |

| |

(e) If you are a qualifying employee, and you have provided investment management |

| |

services for, or on behalf of, a qualifying person for a certified investment fund or a |

| |

specified entity, you can claim salaries tax concessions for eligible carried interest. |

| |

(f) By provisions in the Inland Revenue Ordinance, your income is specifically exempted, |

| |

e.g. those under section 8(2), section 8(2A) or section 87, etc. |

|

You are required to supply the following information and documents: |

| |

(a) If full or partial exemption is claimed for items (a) to (d), you must provide (i) |

| |

detailed computation of the exempted amount and (ii) full itinerary of dates in Hong Kong |

| |

and outside Hong Kong. For section 8(1A)(c) claim, you also have to submit copies of |

| |

the tax receipts and the relevant tax return in support of tax paid outside Hong Kong. |

| |

(b) If salaries tax concessions are claimed for eligible carried interest (item (e) above), |

| |

you should submit supplementary form SP4 which can be downloaded from the |

| |

Department’s webpage (www.ird.gov.hk/soleprop_e). After completion, the supplementary |

| |

form SP4 must be printed out for signing and submitted together with the tax return. |

| |

(c) For all claims, taxpayers will be required to provide full facts in support. |

|

| |

| Section 5 |

Place of Residence Provided |

| If a place of residence is provided to you by your employer or its associated corporation, this part must be |

| completed. Refer to examples in Part 4.2 of this Guide for details. |

| |

| Section 6 |

Connected Entities of the Business that is Chargeable at Two-tiered Profits Tax Rates |

| If your business had connected entities for the subject year, the two-tiered rates will only be applicable |

| to one of them. For paper return, the entity which elects to be chargeable at two-tiered rates is required |

| to submit a complete list showing the names and business registration numbers of all the connected |

| entities in supplementary form SP1 which can be downloaded from the Department’s webpage ( |

| www.ird.gov.hk/soleprop_e). After completion, the supplementary form SP1 must be printed out for |

| signing and submitted together with the paper return. |

| |

| Section

7 |

Notification of Transactions for / with Non-resident Persons |

|

Where you have, as agent, received on behalf of a non-resident person any other |

|

trade or business income arising in or derived from Hong Kong, you will be asked to |

|

give further details of the agency. |

|

Where sums are paid or accrued to a non-resident person in respect of professional |

|

services rendered, wholly or partly, in Hong Kong, you must state the name and address |

|

of each recipient, together with the full amount and the nature of the payment in |

|

a supporting schedule. |

| |

| Section 8 |

Deduction Claims for Expenditure on Research and Development / Environmental Protection Facilities / Intellectual Properties |

|

If deduction(s) is / are claimed for the following expenditure(s), for paper return, you are |

|

required to download the relevant supplementary form from the Department’s webpage |

|

(www.ird.gov.hk/soleprop_e) for completion: |

|

(a) expenditure on research and development (‘R&D’) under section 16B of the Inland |

|

Revenue Ordinance - supplementary form SP2; |

|

(b) expenditure on energy efficient building installation under section 16I of the Inland |

|

Revenue Ordinance - supplementary form SP3. |

|

After completion, the supplementary forms SP2 and / or SP3 must be printed out for |

|

signing and submitted together with the paper return. |

|

If deduction(s) is / are claimed for capital expenditure on intellectual properties under |

|

sections 16E and / or 16EA of the Inland Revenue Ordinance, you are required to state |

|

the amount and the nature of intellectual property. For specified capital expenditure on |

|

the purchase of performer’s economic right, protected layout-design (topography) right, |

|

protected plant variety right, the deduction is applicable to the year of assessment |

|

2018/19 and subsequent years. |

| |

| Section 10 |

Interest Payments Involving Re-mortgaged Loan |

| Refer to example under Scenario 1 in Part 8.4 of this Guide, this part should be completed as: |

| (1) |

Location of property |

Pty A |

| (2) |

Name of lending institution for the re-mortgaged loan |

ABC Bank |

| (3) |

Amount of the re-mortgaged loan |

$2,500,000 |

| (4) |

Interest paid for the re-mortgaged loan in the year |

$112,500 |

| (5) |

Period covered by the interest in item (4) above |

01/07/2024 to 31/03/2025 |

| (6) |

Date of redemption of the previous mortgaged loan |

30/06/2024 |

| (7) |

Balance of the previous mortgaged loan redeemed |

$2,000,000 |

| (8) |

Interest paid for the previous mortgaged loan in the year |

$30,000 |

| (9) |

Period covered by the interest in item (8) above |

01/04/2024 to 30/06/2024 |

|

|

Back to main menu |

and

and in Part 4.1 of BIR60.

in Part 4.1 of BIR60. in Part 4.1 of BIR60.

in Part 4.1 of BIR60.