| Part 13 |

Declaration |

| Making an incorrect return or committing other offences under the Inland Revenue Ordinance may result in heavy penalties. |

| OFFENCES AND PENALTIES

|

|

The Inland Revenue Ordinance provides heavy

penalties for any person who: |

| |

| - |

fails to comply with the

requirements of a notice to make a return |

| |

without reasonable excuse;

|

| - |

makes an incorrect return

without reasonable excuse; |

| - |

makes a false return with

fraudulent intent to evade tax; |

| - |

fails to give notice of

a change or cessation of employment without |

| |

reasonable excuse;

|

| - |

fails to notify a change

of address without reasonable excuse; |

| - |

fails to keep sufficient

records of business income and |

| |

expenditure without reasonable

excuse (maximum fine $100,000); |

| - |

fails to give notice of

the cessation of a trade, profession or business |

| |

without reasonable excuse;

|

| - |

fails to give notice of

cessation of ownership of a property without |

| |

reasonable excuse;

or |

| - |

fails to keep sufficient

records of rental income of property without reasonable |

| |

excuse. |

|

|

EVASION OF TAX IS A CRIMINAL OFFENCE.

THE MAXIMUM PENALTY |

| |

is a fine of $50,000 PLUS a further fine

of 3 times the undercharged amount |

| |

and imprisonment for 3 years. |

For failure to file tax return within the stipulated time or

incorrect return cases,

the |

Commissioner

or a Deputy Commissioner may, instead of prosecuting, make an assessment

|

of

additional tax under section 82A of the Inland Revenue Ordinance.

The maximum amount |

of

additional tax provided by law is 3 times the undercharged amount.

You may visit |

|

Policy Statement of this Department. |

| |

|

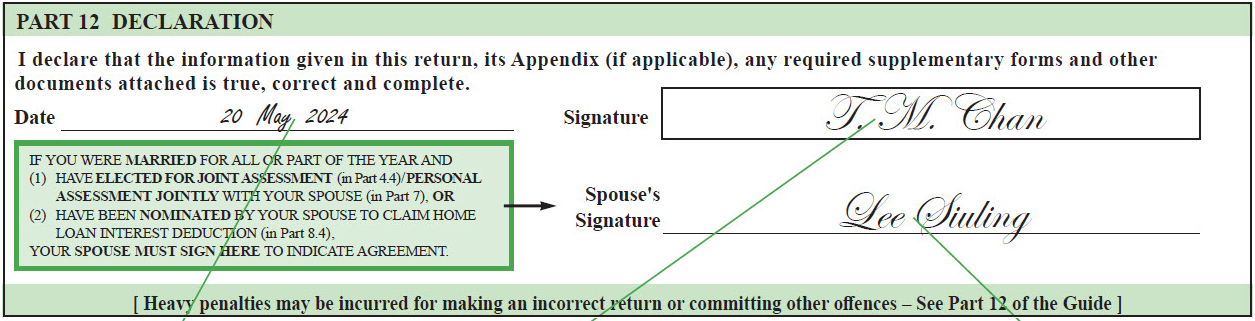

| Example

to show how the Part 13 of paper

return - 'Declaration' is to be completed |

|

| Please put down the date on |

You must sign here to |

Do not forget to ask your spouse to |

| which you complete the return |

make the declaration. # |

sign here if the conditions stated in the |

| and sign the declaration. |

|

green box are applicable to you. # |

|

| |

| # |

If you are unable to write, the affixing of a name-chop, thumbprint or mark as your signature will |

|

be accepted, provided that it is witnessed by a person who is aged 18 or over. The witness |

|

must sign, state his / her name and Identity Card number beside the signature to evidence that |

|

the return is signed by you. |

| |

|

If you file your return through the Internet, please sign your return with eTAX password, |

|

MyGovHK password (only applicable for cases login via MyGovHK Account using |

|

MyGovHK Username and Password), digital certificate or “iAM Smart+” account. |

|

If you were married for all or part of the year and have elected for Joint Assessment / Personal |

|

Assessment jointly with your spouse, or you have been nominated by your spouse to claim |

|

Home Loan Interest Deduction, or your spouse elected to use the Home Loan Interest / Domestic |

|

Rents Additional Deduction Ceiling Amount, your spouse must sign your return to indicate |

|

agreement. If your spouse has not signed your return, the Election and / or Nomination made will |

|

not be accepted immediately. If your spouse wishes to apply for his / her eTAX password on-line, |

|

you should save your return data and quit the filing service, then your spouse uses the service for |

|

application for the eTAX password. Upon application for eTAX password, this Department will |

|

send an access code to your spouse within the next 2 working days for registration of his / her |

|

own eTAX password. |

|

| |

|

Back

to main menu |